rhode island property tax rates 2020

Pensions Benefits Toggle child menu. Rhode Island Property Tax Rates for 2020 tax rate per thousand dollars of assessed value Click table headers to sort Tax Rates Markers.

FY2023 Tax Rates for Warwick Rhode Island FY2023 starts July 1 2022 and ends June 30 2023 There was no increase in our tax rates from last year the tax rates remain.

. The countys average effective property tax rate is. Initial Application for Senior or Disabled Tax Credit. 1965 per thousand dollars of valuation Personal Property.

Monday - Thursday 830 am - 530 pm. Online Tax Bill Payment. 15 Click tap or touch markers on the map below.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Richfield Twp 251160 MT MORRIS CONSOLIDAT 316626 496626 256626 376626 322926. All tax rates are expressed as dollars per 1000 of assessed value. 41 rows West Warwick taxes real property at four distinct rates.

Search Valuable Data On A Property. Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs. For long-term capital gain rates what you pay depends on your taxable.

What are the current Tax Rates. See Results in Minutes. FY 2021 Property Tax Cap.

Such As Deeds Liens Property Tax More. Ad Get In-Depth Property Tax Data In Minutes. Property Tax Cap.

If you have any questions or concerns regarding your assessment please contact the Tax Assessor Office at. Short-term capital gains rates for assets held less than a year are the same as the income tax rates. Discover Helpful Information and Resources on Taxes From AARP.

The current tax rates and exemptions for real estate motor vehicle and tangible property. FY 2019 Property Tax Cap. 2989 - two to.

Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500. The Motor Vehicle Tax. Online Property Tax Database.

FY 2020 Property Tax Cap. Due Dates 1st quarter. Narragansett has a property tax rate of 886.

Pensions Benefits Toggle child menu. The 2022 Tax Rate is 817 per 1000 for Real Property and Tangible Accounts. Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state.

That number recently ticked up to 1474. 2022 Tax Rates Per thousand dollars of assessed value based on 100 valuation. Property Tax Cap.

Newport has a property tax rate of 933. Start Your Homeowner Search Today. Westerly has a property tax rate of 1152.

For tax roll year 2020 the property tax rate for Cumberland was 1432. The municipality of Burrillville also saw a notable rise in. Ad Enter Any Address Receive a Comprehensive Property Report.

Jamestown has a property tax rate of 828. 1965 per thousand dollars of valuation Commercial.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Fifty State Study Shows Property Tax Inequities From Assessment Limits Continue To Grow

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

State And Local Tax Collections State And Local Tax Revenue By State

Rhode Island Property Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Tarrant County Tx Property Tax Calculator Smartasset

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

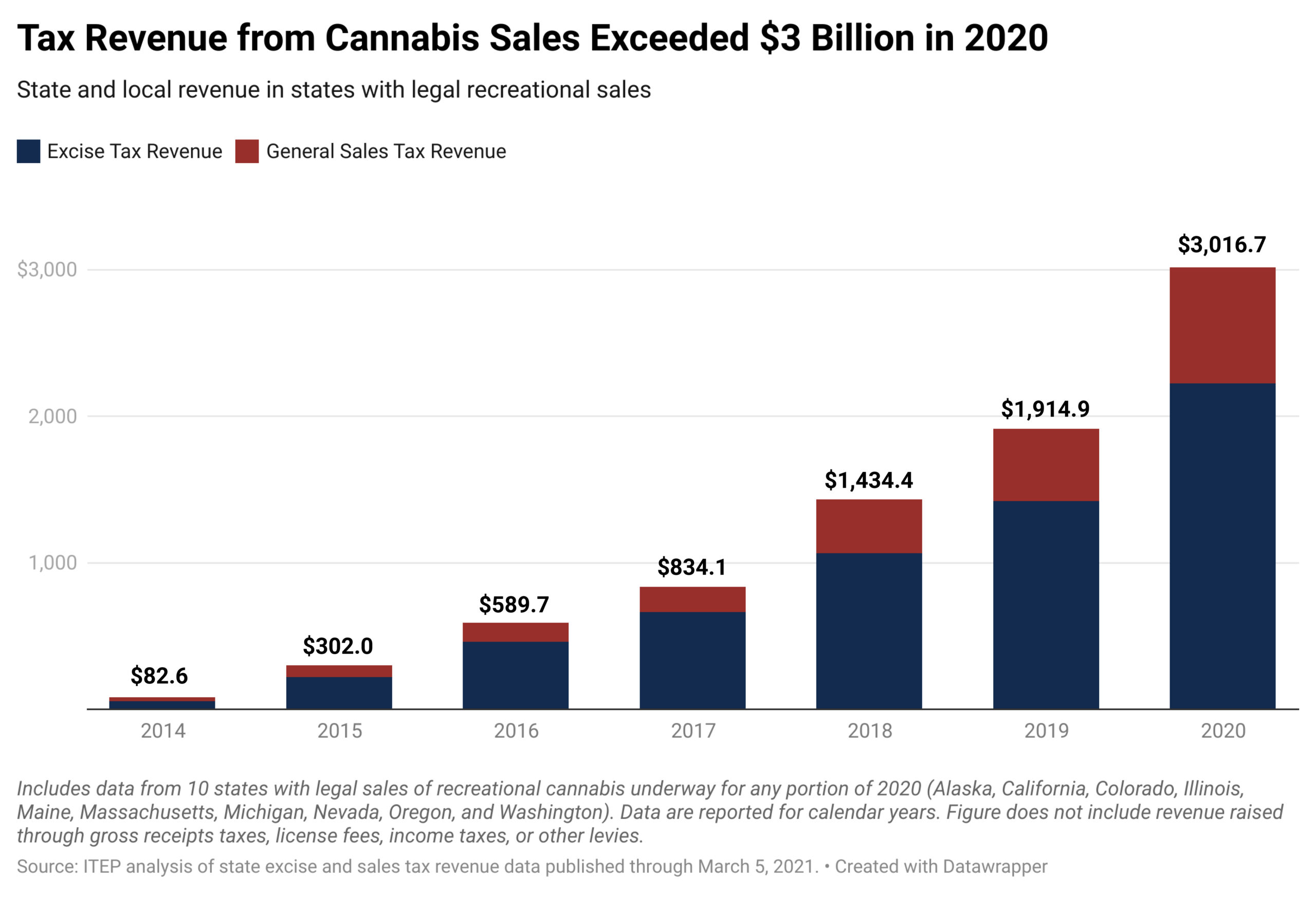

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

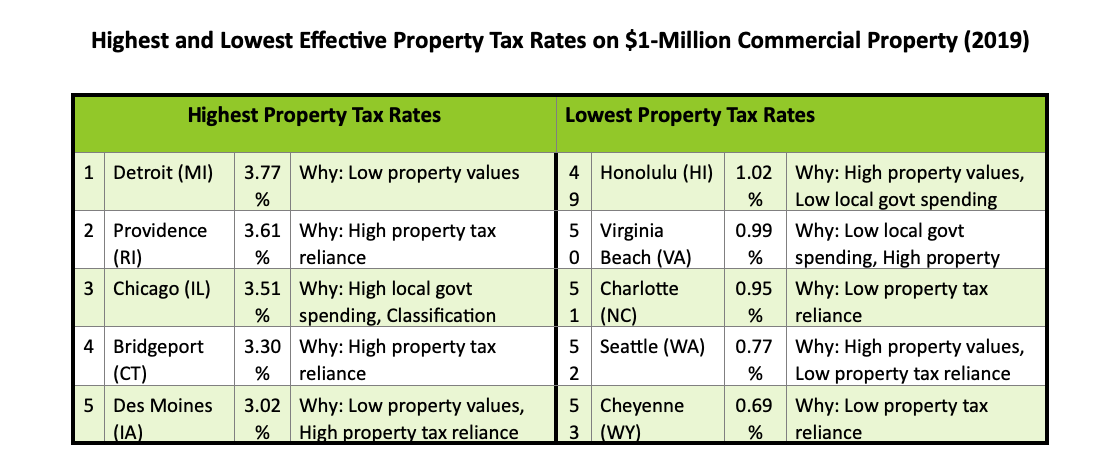

2022 Property Taxes By State Report Propertyshark

State Corporate Income Tax Rates And Brackets Tax Foundation

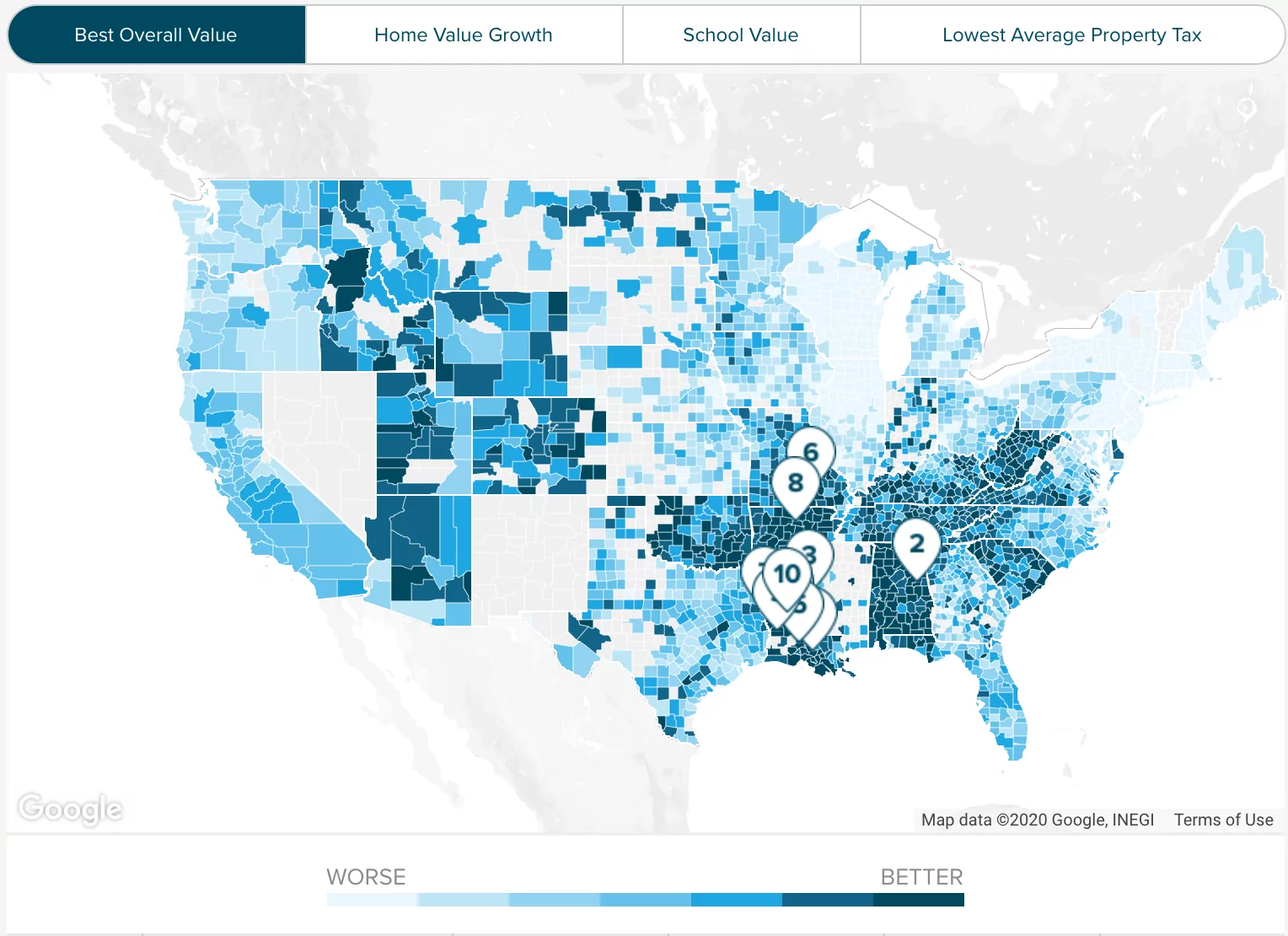

Property Taxes By State Quicken Loans

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

Property Taxes How Much Are They In Different States Across The Us