peoria az sales tax on cars

A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. Arizona collects a 66 state sales tax rate on the purchase of all vehicles.

Used Cars For Sale Larry H Miller Toyota Peoria

This is the total of state county and city sales tax rates.

. The County sales tax. The current total local sales tax rate in Peoria AZ is 8100. This includes liquor licenses pawn shop licenses and other types of business.

4 rows The 81 sales tax rate in Peoria consists of 56 Arizona state sales tax 07 Maricopa. Research compare and save listings or contact sellers directly from 10000 vehicles in Peoria AZ. Impose an additional 250 bed tax effective July 01.

The Arizona sales tax rate is currently. Application and payment for renewal must be received within the Tax Collectors office by such date to be deemed filed and paid. The rate imposed is equal to the state rate where.

Sales Tax Breakdown. Find information on obtaining a business license or sales tax license in the City of Peoria Arizona. While many other states allow counties and other localities to collect a local option sales tax Arizona does not.

View sales history tax history home value estimates and overhead views. The Peoria Sales Tax is collected by the merchant on all qualifying sales made within Peoria. 23 rows Current Combined Tax Rates Peoria State and County Effective July 1 2014.

The Peoria Arizona sales tax is 560 the same as the Arizona state sales tax. The average cumulative sales tax rate in Peoria Arizona is 867 with a range that spans from 81 to 93. County tax can be.

The minimum combined 2022 sales tax rate for Peoria Arizona is. Sales Tax 45000 -. Calculate Car Sales Tax in Arizona Example.

Vacant land located at 25914 N 92nd Ave 1 Peoria AZ 85383. And tax reciprocity with. Cars under 40000 in.

This includes the rates on the state county city and special levels. Retail Sales Tax Brochure PDF Use Tax PrivilegeSales Tax Tax Brochure. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase.

Arizona collects a 66 state sales tax rate on the purchase of all vehicles. However the total tax may be higher depending on the county and city the vehicle is purchased in. The peoria sales tax is collected by the merchant on all qualifying sales made within peoria.

New 2022 Subaru Crosstrek Sport For Sale In Peoria Az Jf2gthrc9nh284305

Used Cars For Sale In Peoria Az Under 15 000 Cars Com

Used Cars For Sale In Peoria Az Cars Com

Used Certified Loaner Vehicles For Sale In Peoria Az Liberty Gmc

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Does Peoria S Proposed Sales Tax Hike Do Enough For Public Safety

New Toyota Camry In Stock Camry Pricing Options Features Toyota Dealership Near Phoenix

Used Certified Loaner Vehicles For Sale In Peoria Az Liberty Gmc

New Vehicles For Sale Acura Of Peoria In Peoria Serving Phoenix Az

Kia Vehicle Inventory Peoria Kia Dealer In Peoria Az New And Used Kia Dealership Glendale Sun City Phoenix Az

Used 2018 Buick Lacrosse Avenir For Sale In Peoria Az 1g4zt5ss7ju137372

Buy Online New And Used Cars For Sale In Peoria Serving Phoenix Az

New Vehicles For Sale Acura Of Peoria In Peoria Serving Phoenix Az

New 2023 Kia Stinger Gt Line For Sale In Peoria Az Knae35ld9p6125236

Used Cars For Sale In Peoria Az Under 10 000 Cars Com

What S The Car Sales Tax In Each State Find The Best Car Price

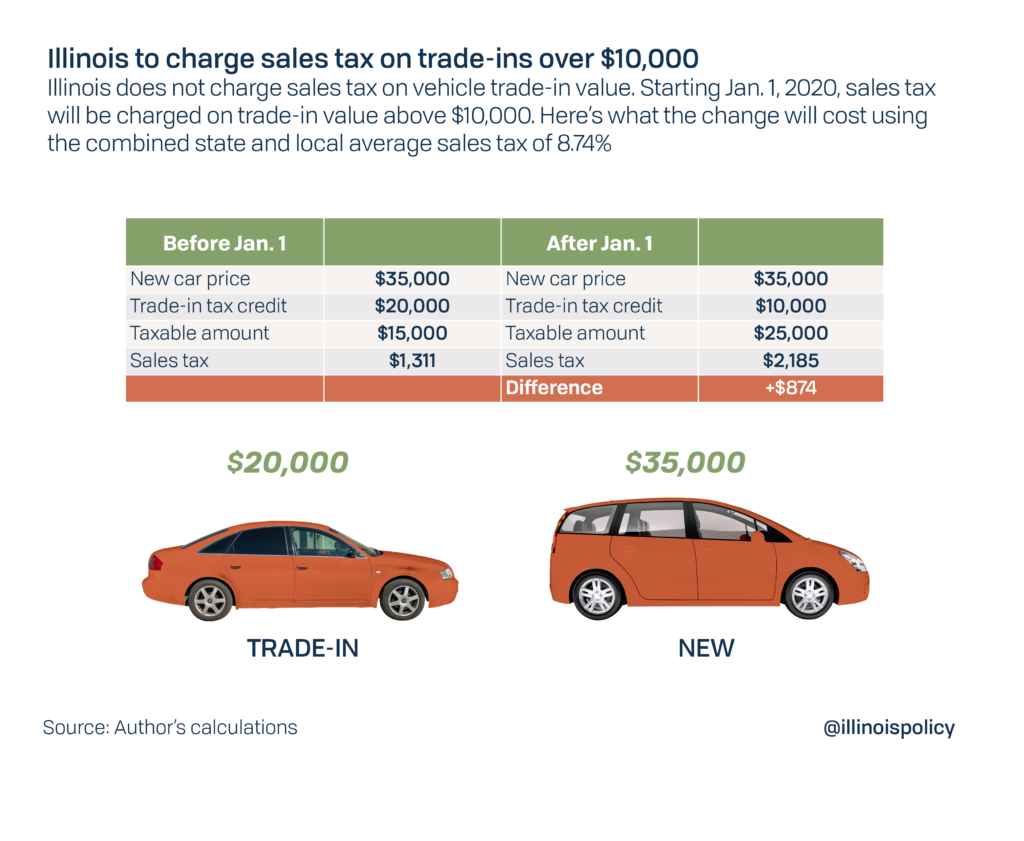

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

New Chevrolet Camaro Vehicles For Sale In Peoria Phoenix At Autonation Chevrolet Arrowhead